Check, Please: Deductions for Business Meals and Entertainment Expenses Have Changed

If you think that recent sandwich-spread for your internal business meeting or meal with your business partners at the restaurant was eligible for a 100% tax deduction, you’d better think again.

As of January 1, 2023, the deduction of a business-related meal will revert to the standard 50% limitation as outlined in the Tax Cuts and Jobs Act of 2017.

Previously, under the Consolidated Appropriations Act of 2020, taxpayers have been able to deduct 100% of the cost of meals in 2021 and 2022, as long as they were purchased from a restaurant with a business purpose. This legislation was meant to reward businesses for supporting the struggling restaurant industry, hurt by the pandemic.

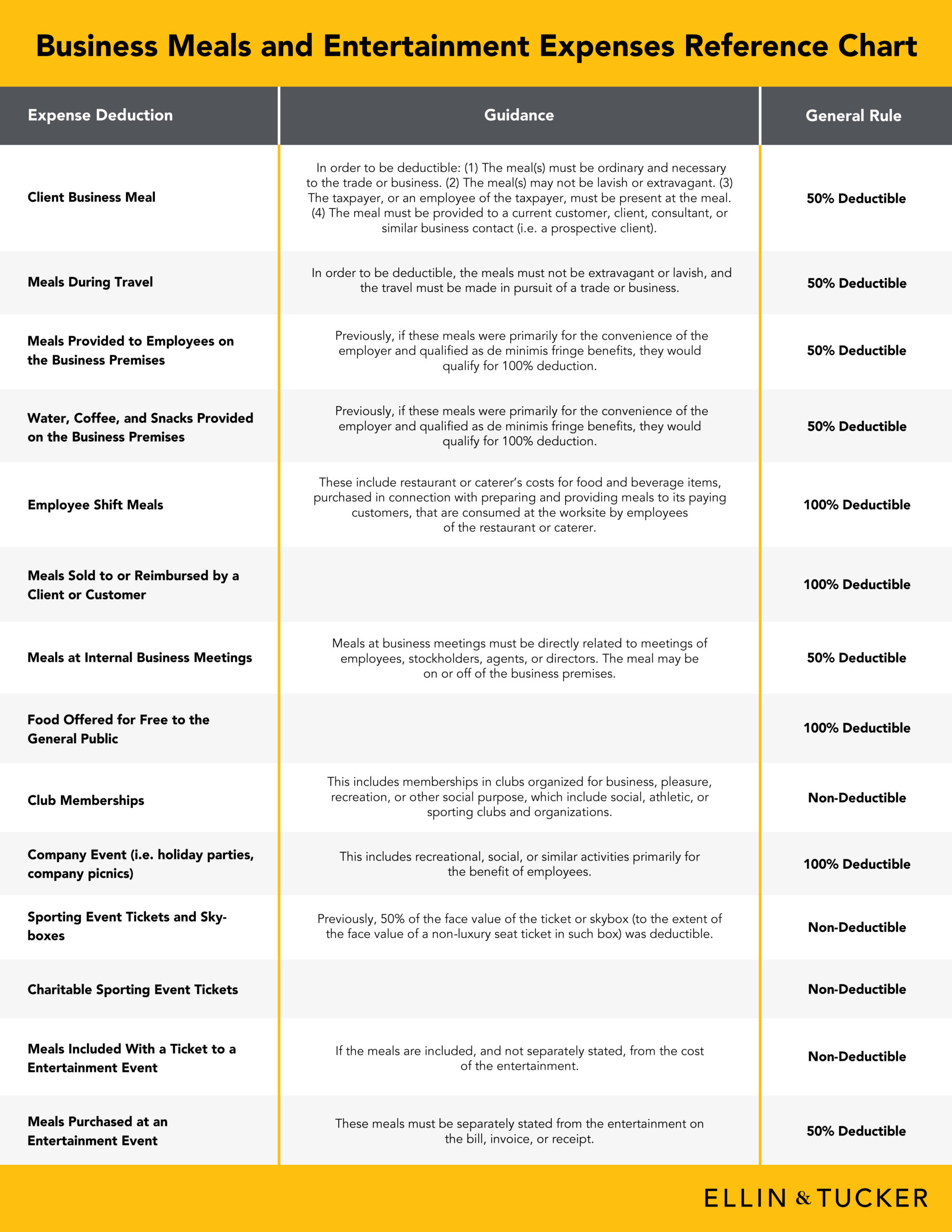

Below is a reference chart showing the types of business meal and entertainment expenses, and the deductibility you can expect moving forward.

Click here to download a PDF of the Business Meals and Entertainment Expenses Reference Chart.

Navigating these changes can always be challenging, and every situation is unique. The tax experts at Ellin & Tucker are always prepared to help you get a better understanding of how these changes impact you and your business.

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.