Don’t Wait Too Long to Make Your Large Asset Purchase!

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 included an important correction referred to what was called the “retail glitch” in the Tax Cuts and Jobs Act of 2017 (TCJA). The much anticipated correction in the CARES Act properly classified Qualified Improvement Property placed in service after December 31, 2017 to have a 15-year recovery period, making it eligible for the 100% bonus depreciation included in the TCJA. This provision was initially put in place as an incentive for small businesses to make investments in assets to help stimulate the economy.

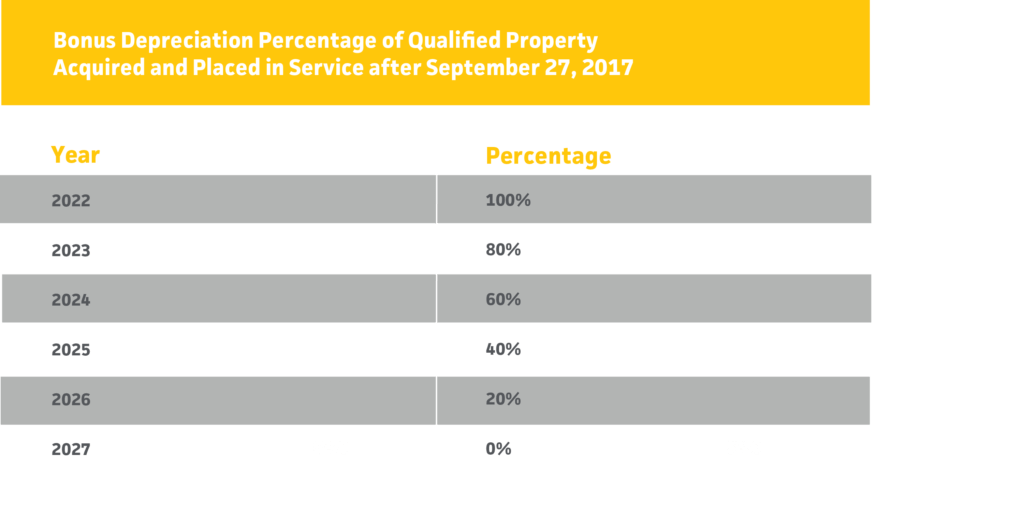

However we know all good things come to an end, this incentive included. Luckily, the 100% bonus depreciation doesn’t abruptly stop. Instead, the provision will slowly phase out over the course of the next five years, with 2022 being the last year businesses can take 100% bonus depreciation and 2027 being the year in which bonus depreciation for qualified assets is fully phased out.

That being said, taking advantage of this deduction before it begins to sunset could be a strategic move for business owners looking to make qualified asset purchases.

Under this quickly dissipating provision, the question to ask now is what could be considered qualified property? The following is considered as such:

Typically the asset has to be Modified Accelerated Cost Recovery System property with a depreciation period of 20 years or less that has been placed in service after September 27, 2017 and before January 1, 2023.

In order for business owners to properly plan their large asset purchases, they should be aware of the timeline for the bonus depreciation percentage decrease.

2022 being the last year for 100% bonus depreciation could be the motivation business owners need to make the next big purchase before the phase out begins. We always advise speaking with your financial advisor and CPA about your specific situation in order to help you plan your asset purchases properly.

2022 being the last year for 100% bonus depreciation could be the motivation business owners need to make the next big purchase before the phase out begins. We always advise speaking with your financial advisor and CPA about your specific situation in order to help you plan your asset purchases properly.

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.