Families First Coronavirus Response Act and Payroll Tax Credit

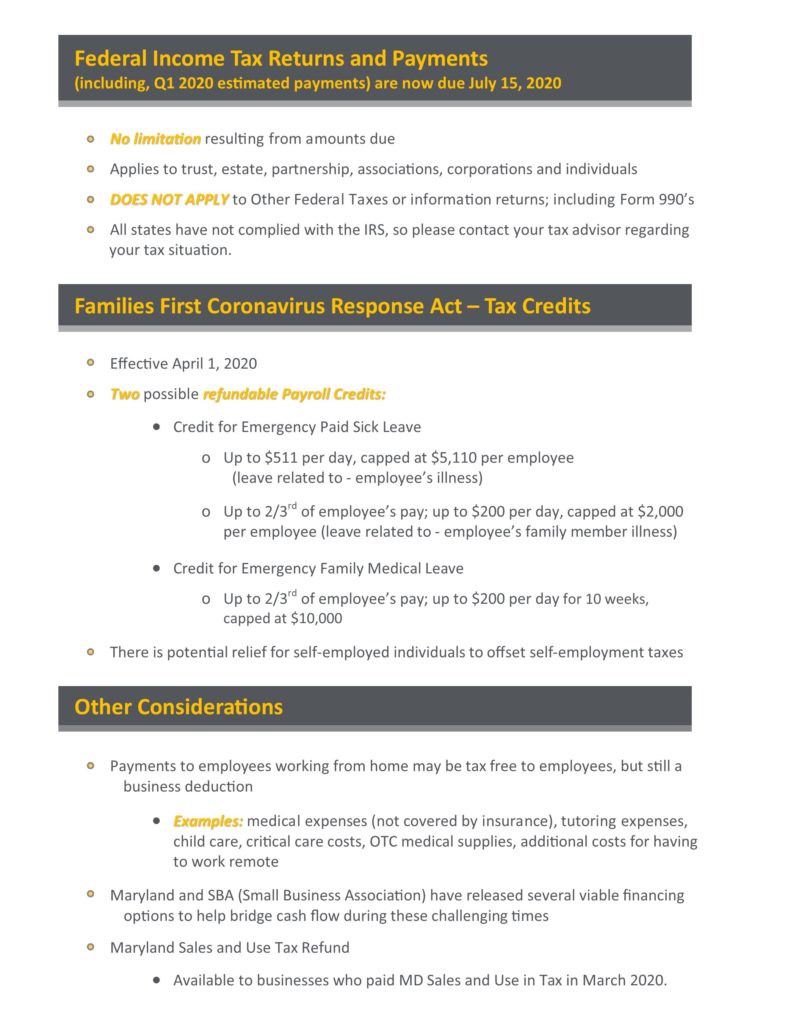

On March 18, 2020 the “Families First Coronavirus Response Act”, (“FFCRA”), was signed into law by the President. The FFCRA becomes effective within 15 days (April 1, 2020) from passage. Therefore, employers should immediately begin preparations to comply with the new law.

The law enables small and midsize employers to have access to two new refundable payroll tax credits designed to reimburse them for the cost of providing Coronavirus-related leave to their employee. The hope of the legislation is to enable employers to keep their workers on their payrolls, while at the same time ensuring that workers are not forced to choose between their paychecks and the public health measures needed to combat the virus.

The majority of this law is centered around employment law and therefore it is recommended that all employers discuss this with their employment law counsel or specialist to address how to comply with, and implement, the underlying employer obligations and employee rights. However, once it is determined that any employee is eligible, and your company is liable, for benefits under this new law we will help guide you on how to receive and/or apply for the tax credits that are meant to fund these new benefits.

Information on the application of, or application for, the tax credits is still developing. With only a little over a week until this law is effective the IRS and Treasury plan on providing more detailed procedures around the tax credits this week. However, there is some information out already that proves helpful. See below for highlights and our current understanding of the tax credits:

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.