What Construction Entities NEED to Know About the New Revenue Recognition Standards

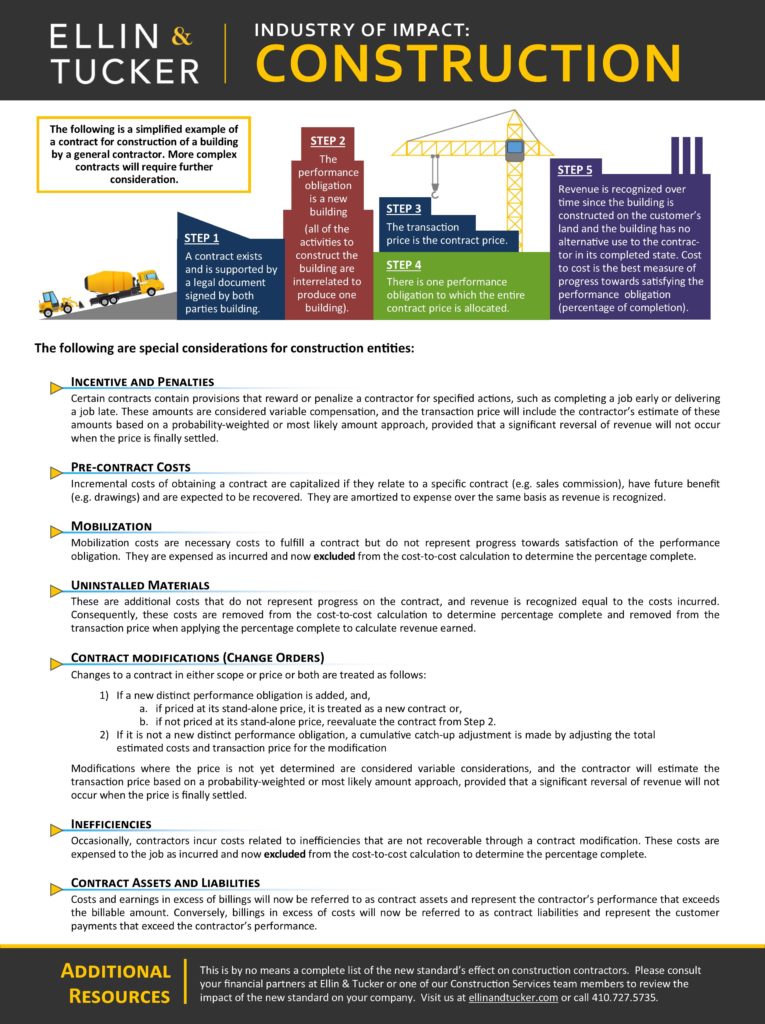

The Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2014-09, to align accounting standards, reduce industry-specific complexities, and shift the thought process of recording revenue from a rules-based process to a principles-based approach.

This new standard replaces nearly all existing revenue recognition guidance and will go into effect in calendar year 2018 for public business entities, and calendar year 2019 for private companies.

We understand that these standards will have a profound effect on the way that your business recognizes and records revenue. To help make the application of these standards easier to understand, we’ve created a series of short guides to help you navigate these changes. In November we released our general guidelines to recognizing revenue under the new standards, which can be found here: What You NEED to Know About the New Revenue Recognition Standards.

To view the Construction Entity guide, please see below, or click here to download the PDF. The PDF includes the general guidance in addition to the Government specifics listed below.

If you’re interested in the other four industries included in this series, please see the following:

Get ready, because by subscribing to our email insights, you'll be among the first to hear from our experts about key issues directly impacting your privately held business or not-for-profit.